Recently I’ve been a lot more interested in the eco-friendly ways to furnish my home on a budget.

Maybe it started from my furniture flipping side hustle, but I started to see how many great pieces get donated, sold, and trashed when we change our style.

So when I was ready to retire my old white sectional, with a tear on it, I started shopping around.

I hopped on some websites and found a few pieces that I was obsessing over… the only problem was it was crazy expensive!

My Living Room Vision

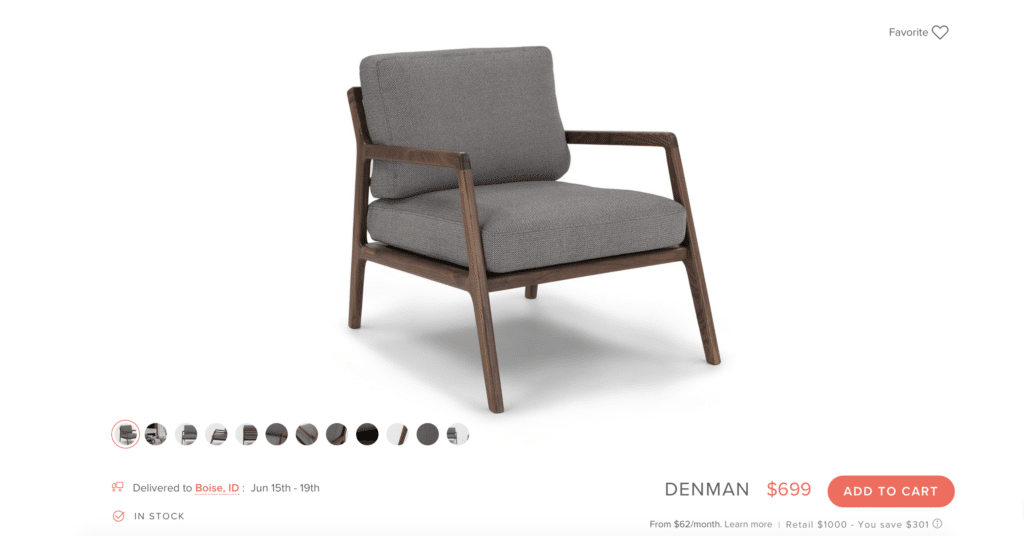

I found these gorgeous chairs from Article for $699 each. I wanted two of them for my living room, so I was looking at a total of

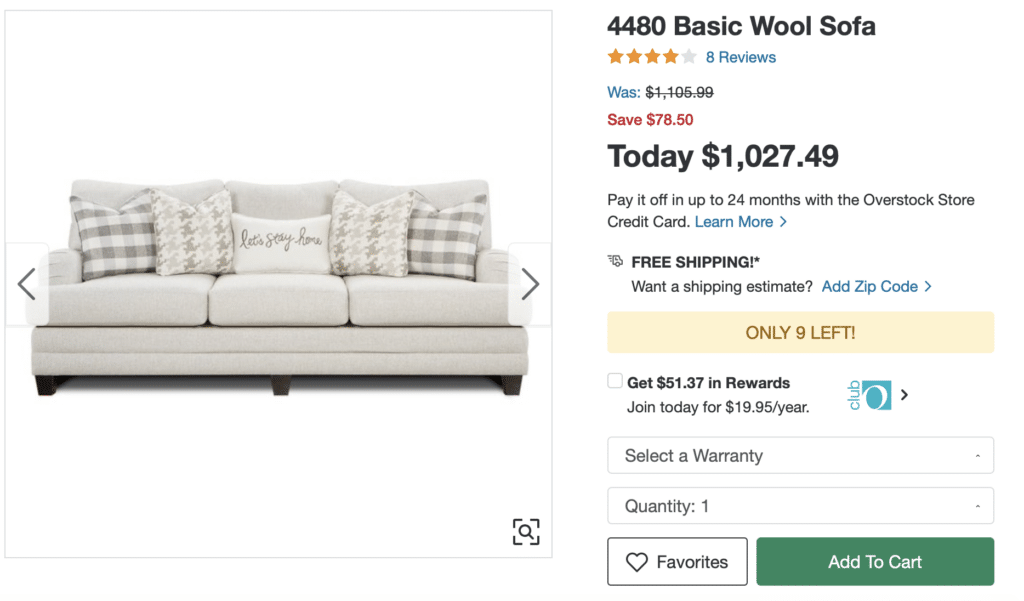

Then I started looking for a linen white colored sofa. (My personal style for right now tends to be a bit more contemporary/comfy with muted colors.)

I wanted something pretty plain and simple. I saw a ton of options from $500-$3,000 for a freaking couch.

Honestly, at that time, I couldn’t justify the cost and know that furniture has a huge markup so I decided to get creative and see what I could find second hand or from thrift stores.

My Thrifty Finds

I started looking on Facebook Marketplace and low and behold I found these chairs for $400. These were such a perfect dupe of the Article chairs that I didn’t even negotiate a lower price. LOL! (Which is very unlike me.)

Next I started looking around for a couch. I found this one on Facebook Marketplace for $250. I asked if they were flexible on the price and they said they would take $200.

Both the couch and chairs were in incredible shape with no stains and no tears.

Here are a couple more shots of the living room all pieced together.

I was able to sell my old sectional for $150, so the total out of pocket cost for me to refurnish my living room was $450! I saved almost $2,000 by just shopping used!

- Love my electric fireplace? I built it and you can too! Learn more about it here.

Next time you go to redo your home, get creative, patient and look at thrift stores and on Facebook Marketplace.

I promise, if you stay patient– you will find something that fits your budget and makes your space look brand new.

What Else To Look For at Thrift Stores

Keep your eyes open for home decor items from thrift stores as well. You can find all kinds of treasures. With a simple can of spray paint, you can transform almost anything.

Look for lamps, end tables, candlesticks, random accent pieces, or even blankets (don’t worry, you can wash them).

I recently found a candle from a local candle shop that sell the most amazing scents. This candle was brand new and only $1.99.

Next time you go to give your space a transformation, I hope you look for used first before buying brand new. It’s good for the environment and budget friendly!

Happy decorating!

Whitney

Have you refinished your space using thrifted/second hand pieces? Tell me about your favorite finds!

I’ve been painting and furnishing my kids’ rooms this year, and paint and curtains have been the most expensive bit so far, though I did find a gallon of really dark gray paint from the ReStore for $10. I mixed a little of it with some white I already had have a ton left (I’m thinking my bathroom may need to be gray, too, lol). I bought a desk from FB for $15 (already red like my boy wanted so didn’t have to paint it), a bookshelf for $4 and a dresser for $5 at yard sales, two more bookshelves for FREE from my neighbor who is getting ready to move, and I made my own curtain rods from electric conduits and some hardware, two of them for $10. It’s taking longer to piece it all together, but it’s better than staying white and boring because I don’t want to fork over 100s of dollars all at once.

Once they’re all done, I’m going to work on finding a desk, bookcase, and two side tables for MY room, all thrifted and made over with my own personsl touch, of course.

Your livingroom looks great! Very classy.

Yes! Excited to see what you come up with.