The Start

Reality.

2010 was a great year; I graduated college, I got my first “big kid” job at a public accounting firm and life was looking promising.

There was only one problem. I had almost $30,000 in debt staring me in the face. Yikes!

For some, that is okay, student loans are normal.

I didn’t want to be normal. I wanted to be successful.

I wanted to make my own choices instead of having debt make choices for me. Intuitively I knew that $30k was a crap ton of debt.

The debt was making decisions for me, instead of me making my own decisions. I couldn’t take a job at a non-profit (paid too little) and I couldn’t start my own business, because I had debt to pay for.

My paycheck was officially owned before I even got my hands on it.

Sound familiar?

Most of us know that debt takes away our freedom.

It’s easy to say c’est la vie to a job that you can’t stand when you don’t have to worry about paying for the bills.

I talked to a lot of people and what I found was disgustingly shocking.

|

People had students loans well into their 40’s and 50’s. Seriously?! Treating them like they are a necessary part of your life will cost you. What are the costs, you ask? Well…

Your freedom. I’m glad you are reading this. Clearly you are much smarter than I was. It took me years to figure out that debt was stifling my growth. I didn’t even know I had problem until it hit me in the face – rather abruptly too. Okay, let’s get down to business. |

|

|

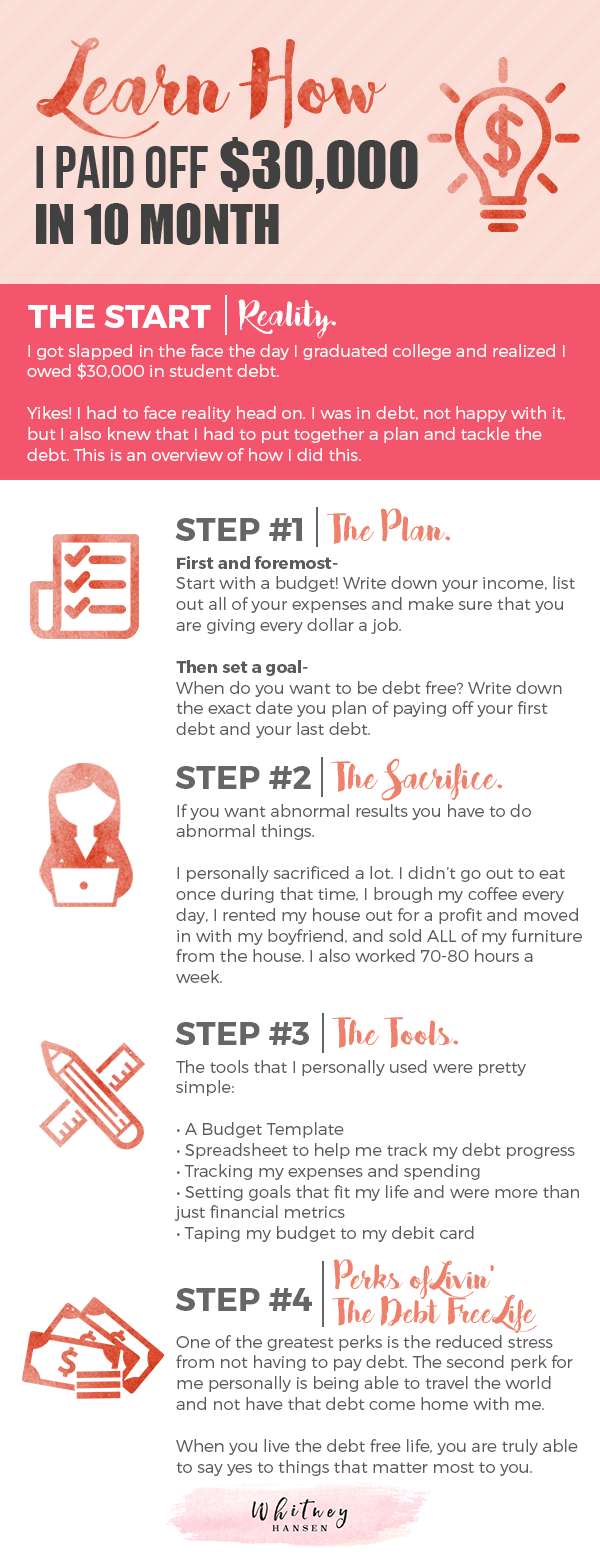

Step #1The Plan.In order to tackle the Goliath of a debt, I needed a plan. Something that was actionable, measurable, and ambitious. I also needed a shovel. I dug a pretty deep hole. Therefore, I needed a pretty big shovel to fill that hole. I’ve always been a big believer in the saying… “If people aren’t laughing at your goals, you aren’t dreaming big enough.” My first goal was to pay off my debt in 12 months, 1 year. When I shared this goal, I not only got some strange looks, laughs, and smirky smiles, I was told I set my bar too high. This is normal. Anytime you go about trying to achieve a massive and audacious goal, people will try to put your dreams down. Don’t let them. People project their version of the world onto you. If they don’t think it’s possible for them to personally accomplish the goal, they will tell you it won’t be possible for you to do it either. On October 10, 2010 I wrote in a notebook: Pay off $30,000 by October 2011. Due to the power of setting goals correctly, I actually beat my goal by 2 months. In August of 2011, I made my final student loan payment. That night, I slept like a baby. |

|

|

Step #2The Sacrifice.“Great results come at great sacrifice.” It’s virtually impossible to accomplish cool things in your life without making some tough choices. Trust me when I say, you will not be able to please everyone and your decisions will often hurt someone in the process. I have always been good at working my butt off. Part of my plan of paying off my debt was knowing that I had to make some really, really big changes. Cutting out buying coffee twice a week was not going to cut it. To get drastic results, I had to make drastic changes. Here was my pre-debt freedom situation:

Great! I was in a pretty solid starting position. Here were the sacrifices I made:

|

|

and probably the most important sacrifice… My lifestyle choice.I knew I could survive on less than $25,000 a year. Heck, I knew with my house rented out I could survive on $15,000 a year. I lived in true “college student spirit” a little while longer. Let me introduce you to my massive shovels. Shovel 1 (Spa Job):This was my job that put me through college. I lived on a solely commission-based income for 4 years and knew I could continue living off of it. Working part time at the salon meant that my income would decrease to around $25,000 a year. I worked from 4:00 – 8:00 p.m. on Tuesdays and Thursdays, 11:00- 8:00 p.m. on Fridays, and from 9:00-6:00 p.m. on Saturdays. 26 hours a week. 100% commission. Perfect. Shovel 2 (Accounting Job):Accounting is very cyclical business. I was deeply needed for audits and preparing tax returns. I worked at the accounting firm Monday, Wednesday, and Sundays from 7:00 a.m.- 6:00 p.m. Tuesday and Thursdays from 7:00 a.m.- 3:00 p.m. 49 hours. I was paid once a month at this job. |

|

Have you ever been so busy that you literally couldn’t even make it to the bank, let alone go shopping? That was my life. Being so busy was a huge blessing in disguise. I didn’t even have time to spend money if I wanted to. My sacrifices were drastic. I wanted unreal results, and I got them. It wouldn’t be fair if I didn’t discuss the tools I used to make this happen. These financial tools were the real reason I was able to accomplish this goal. |

|

Step #3The Tools.A plan isn’t enough. Working two jobs isn’t enough. Sacrificing isn’t enough. You need to have the right tools under your belt. Let me repeat that…. “Most debts are fun while you are acquiring them, but none are fun when you set about retiring them.” I learned firsthand the importance of creating an effective budget. Creating a budget is nice, easy to do even.. …but creating an effective budget- that’s a different story. What was in my toolkit? Ridiculously easy, step-by-step formula to accomplishing cool shitThis is an art and a science. There are proven research based ways to make your goals more attainable and increase your odds of achieving them ten- fold. There are actually 7 areas you should be setting goals in. Isn’t that crazy?! Within minutes of talking to you and hearing your goals I can immediately determine the likelihood of you achieving them. I want you to succeed! So be sure you are setting goals in these 7 areas:

Effective BudgetingLearning how to create an effective budget is critical. Fortunately, I learned some extremely valuable tips to creating a budget that works. Effective budgeting makes your money start working for you. It takes into consideration paying off debt, building up an “oh sh*t fund,” saving for retirement, and even sneaky expenses like holidays and birthdays. If you set-up your budget correctly it will be a truly effective one. |

Tricks to saving hundreds on student loan interestOne trick to paying off debt faster is by paying principle only. Your payment is composed of two main pieces: Principle & Interest When you make a payment, the amount paid is divided into interest and principle. Paying principle only means that your money is going toward the amount borrowed only- not to the banks pockets. But did you know you can’t pay principal only on student loans? Don’t worry; I learned a secret workaround for this. This secret literally saved me hundreds of dollars. And i even put my finding in this handy cheat sheet and added a couple more tips in the cheat sheet as well. It’s free, so download it, print it off and keep it handy as you go through your paying off student debt process. Tips to staying motivated while getting out of debtGetting out of debt isn’t easy. There are a ton of different tips and tricks I learned while paying off my debt. You’ve got to consistently go back to your “why.” Why are you getting out of debt? What are the feelings you felt that led to you wanting to make this change? Are you embarrassed? Did you overdraft your checking account? Did you not have enough money in your account and couldn’t buy groceries? Going back to your why will keep you motivated throughout this process. |

|

|

Step #4Perks of Livin’ The Debt Free LifeDo you know how nice it is to have the freedom to travel whenever you want, spend $500 on a shopping trip guilt-free, and purchase luxury items? It’s not out of your reach. You can do it. In May 2014 I went to Kauai. Kauai is a beautiful, beautiful island. I hiked along the Napli Coast, some of the most rugged and gorgeous terrain, snorkeled with tropical fish and turtles, watched endangered monk seals snooze, rode in a helicopter around the island, drank Mai Tais, relaxed while reading on the beach, and my favorite- got caught hiking in a tropical rainstorm. But the best part of livin’ the debt free life… When I return home, I have only the memories with me- not the credit card bill. Imagine what you can do when you no longer have to worry about debt.Best of all, I’m able to start my own business without the financial stresses that go with it. As an entrepreneur, living a very low risk life is important to me and keeping my monthly expenses to a minimum makes a huge difference in business growth vs. business flop. |

|

I really hope this post has helped you gain some insights around what I did to pay off my debt. I am a very normal, average, person. If I can do, anyone can do it. |

How to Pay off Debt Workshop

Enter your name and email to get access to the training instantly.

(link will be sent directly to your email)

Awesome guide Whitney and your story is very inspirational! I’m a mom, working and freelancing in order to pay off the rest of my $19,000 in student loans by the end of next year AND get married. It gets discouraging at times but your tips definitely help. I know exactly what you mean by being too busy to even spend money or go to the bank. I only check my bank account every other day if I’m lucky and I visit the bank once per week after work on Friday to make withdrawals and such. Thank goodness for direct deposit! 🙂

Thanks Chonce! Way to go on paying off your own debt! It sounds like you are kicking butt (AND you have some big life changes coming up!) How exciting. 🙂

You’re so right, direct deposit is so helpful!

Hi Whitney!

My husband and I are in a similar situation with our debt. We are working towards debt-free living!! Last year we were starting to get the feeling of “if nothing ever changes…. Nothing will ever be different”. We were soo broke it was a challenge to get enough food to eat for the week. We had almost $70k in student loans, credit cards and medical bills. With the help of our families we took drastic measures. We packed up our spacious, lake view apartment in New Hampshire. We sold 90% of our clothes, shoes and belonging (including ALL) of our furniture. In July I packed up my tiny 2 door Toyota Yaris hatchback with EVERYTHING we owned and made the 7 day trip to Washington State (4000 miles away)!! We moved into a small bedroom in my in-law’s house. They were gracious enough to offer us a living space rent and utilities (and food) FREE!!!! In only 5 months we were able to pay off all of my husband’s debt. His portion was tiny compared to mine but we are working in that direction. It feels sooo great to say he is debt-free. Some things that have really helped us have been major budgeting, vision boards, lllloooonnngggg hours at work, creativity in free date nights and help from our friends and family. Sometimes I really do miss our old place and our old life!! I miss lazy evenings when my husband got off work at a regular time and we would curl up together on our couch. I miss having my mom and my sisters over for “coffee”. I miss walking naked from the bathroom to the bedroom after a shower. I even miss grocery shopping!!! However, I DO NOT miss sleepless nights trying to figure out how to make a dime cover a dollar. I don’t miss the tears. I don’t miss trying to make up excuses as to why we couldnt do the fun things our friends were doing like going bowling or weekend trips to Boston. I don’t miss the harrassing calls from debt collectors and student loan officers. We still have a loooonnng way to go to be totally debt-free, but we are actually so excited to be on this journey!!!! Thank you for your blog. It gives up hope that it CAN be done!!!! Someday we will be debt-free like you!!!!!!

Amy, your story is incredible!! With that kind of sacrifice you are well on your way to being debt free! Congratulations!

I really appreciate you sharing what you miss and don’t miss. Another thing that really helped me with staying motivated was constantly listening to inspirational YouTube videos and podcasts. It really does make a big difference!

You rock! Stick with it, you’re already seeing amazing results. 🙂

Congrats on paying the debts! Unfortunately, most people do not have a house that they can rent out and that is what really kicked the debt for ya.

Hi Britt,

Thank you! And big thanks for your comment. 🙂 Surprisingly, renting the house was a not the biggest kick towards the debt. That only brought in $100 per month as I was still paying rent at my partner’s home. It was that pesky second job that made the biggest dent. (All worth it though!)

I love this article! Can you give me a resource or contatct about what you should and should not do when consolidating studetn loans or not. I am just not sure what do do with mine. Do you have a Student Loan expert, site, or book that can help with that?

Ignore that first comment! I hit post before I edited!! 😉 I love this article! Can you give me a resource or contact about what you should and should not do when consolidating student loans or not. I am just not sure what do do with mine. Do you have a Student Loan expert, site, or book that can help with that?

Camille, without knowing too much of your situation there are a lot of things to consider before consolidating.

1) Is there a fee? Usually there is.

2) Does the consolidation mean the loans are no longer Federal loans? As much as I hate owing the government money, they also work with you a lot if you go through an economic hardship and need income based repayment, or deferral. Consolidating them might mean you lose some of those options.

3) Do you need to consolidate? When I had my loans, consolidation would have been a waste of time as the loans were all through the Direct Loans, so even though there were multiple different loans, I only made 1 payment.

4) How long can you realistically pay off the loan? The answer to this question and #1 will determine if it’s even worth it.

Now refinancing could be a different story. But consolidation doesn’t always help.

Shoot me an email if you have any questions and want to talk it out. 🙂 [email protected]

I know this is a super old article, but I just found your blog through Pinterest. I want to say thank you. A lot of finance blogs that I have read gloss over the actual details of how the writer got out of debt. I appreciate you going into the nitty gritty of it and then following up your story with tips for those of us still working our way out. I have a feeling I will be getting lost in your articles because so far, I’m enjoying the ones I have read.

Stacy, thank you so much! I’m so glad you appreciated the detail. 🙂

Really love the article about how you managed to pay off your student loan. Thankfully enough, while I do not have student loan, I have a personal loan and a mortgage hinging on my salary, since the husband just started his marketing business.

Getting such second jobs is not very easy or effective in India. However, I got myself a CFP degree and started blogging about personal finance and money in India. It is at a nascent stage for now but I do believe it has a high potential to become a major side hustle for me that can help me pay out our loans.

Thanks once again for the inspiration through your personal story.

Thanks Aparna! I appreciate you reading and am so glad you enjoyed it. Good luck with your CFP and blog! Looking forward to checking it out.