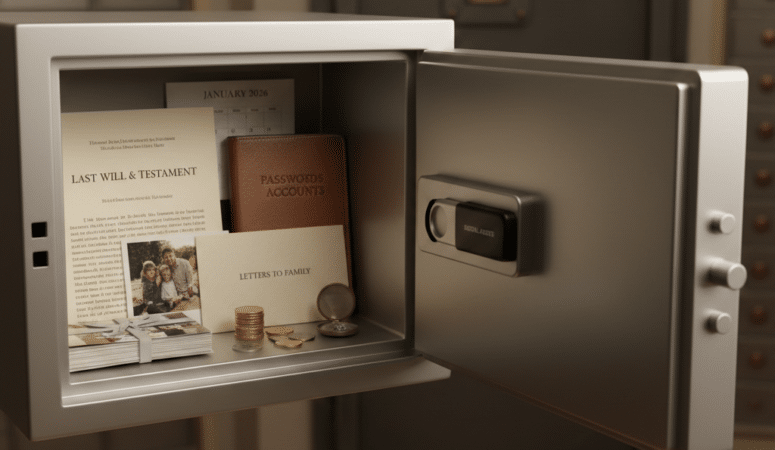

On The Money Nerds Podcast we are tackling the not so fun, but oh-so-important topic of creating your own dead box. What is a Dead Box? And Why You Need To Create One A “Dead Box” is essentially a digital folder of all the important financial documents that your loved ones would need for when you pass. Having this information… Read More

How to Set Financial Goals Without Feeling Overwhelmed

Setting financial goals should feel motivating—not exhausting. But for many people, trying to save, invest, pay off debt, and plan for the future all at once leads to stalled progress and frustration. If you’ve ever wondered why your financial goals never seem to stick, the problem might not be your discipline—it might be your strategy. This is where the Goal Snowball approach can help…. Read More

What Lifestyle Creep Really Looks Like in Your 30s (And Why It Feels So Hard to Spot)

If you’re earning more than you used to, but somehow feel like saving is harder than ever —you’re not imagining things. This might be lifestyle creep in your 30s.And it looks very different than we were warned about. It’s not flashy spending.It’s not luxury cars or designer handbags. It’s convenience.Comfort.And a lot of “this just makes life easier.” Lifestyle Creep… Read More

8 Day Financial Reset: A Simple Way to Feel Back in Control of Your Money

If your finances feel a little messy, overwhelming, or just off, you’re not alone. Most people don’t need a complete financial overhaul—they need a financial reset. In this episode of The Money Nerds Podcast, I’m walking you through an 8-day financial reset designed to help you get clarity, build momentum, and feel confident about your money again—without doing everything at once. Think of this… Read More

We Built A GLAMPING DOME– How we set up a Geodesic Dome Airbnb!

I’ve always had a goal of making $100K a year off of unique short-term rentals. I believe that unique, quirky, properties are more recession-proof, interesting, and a totally fun experience for guests— and have a higher ROI. In 2020 my partner and I bought a 1-acre piece of property for $35,000 in the mountains of Idaho. Thought we would build… Read More

Financial Tasks For End of Year

Alright, alright. I know no one wants to think about the end of the year and what we might need to do to close out the financial year– but it’s important. There are several financial tasks that you may want to consider completing at the end of the year. Here are some ideas: Review your budget Take some time to… Read More

BUDGET TIPS: How to plan for inflation

No doubt about it, we have all been feeling the effects of inflation. As a whole, the US experienced overall inflation of 7.5% in ONE YEAR. (US Bureau of Labor Statistics). So what does that mean for all of us? Shiz is getting more expensive. But not all categories experienced the same amount of inflation. Here are some of the… Read More

What’s The Best Way To Discipline A Child?

Our childhoods have a huge impact on our lives. They play a big role in shaping our beliefs, choices, and who we are today. I personally don’t have kids, but I am fascinated with the topic of raising children. I come from a family of six, so it’s inevitable not to be around kids. Today, I had the privilege of… Read More

Preparing For The Unexpected: How To Deal With Grief

Life is unpredictable. Sometimes, unexpected things happen, both good and bad. We don’t like to think about the bad, much less highly tragic events, such as a death of a loved one. Yet, it is inevitable, and we need to prepare for the unexpected. In today’s episode, I interview my friend Kristie St-Germain, creator of the Widowed Mom podcast and… Read More

- 1

- 2

- 3

- …

- 24

- Next Page »