A lot of times, being successful with your monthly budget is simply being aware of your expenses. From coaching and working with over 150 people in the last year, I have found that most common issue is surrounding personal finance is the lack of organizing information.

Enter budget binder.

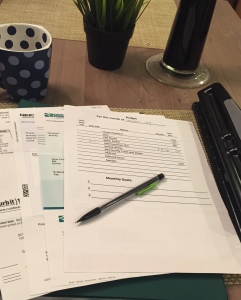

A budget binder is a very basic way of tracking your bills. It helps. Below is a picture of what this actually looks like. You start with a summary sheet, put the bills behind the summary sheet and keep track of the amounts, dates paid, due date, and even some of your monthly goals.

Let’s walk through the steps of how you can create your own budget binder.

This is exactly what I do at the beginning of every month. I create a bi-weekly budget and get my budget binder out.

What you need

-1 inch binder

-3 hole punch

-Sticky notes

-Coffee (always a necessity when working on your budget)

Steps

Step 1: Set aside at least 1 hour to set up your binder and get your first month going.

Step 2: Take a sticky note and write down all of your username and passwords for your online bill pay. Keep that in your binder.

Step 3: Create your “Monthly Summary Sheet” or download template here.

Step 4: Keep a copy of your bill (utility, car insurance, etc) behind the Monthly Summary Sheet. Write directly on the bill the date you paid the bill and the confirmation number if applicable.

Step 5: Write down your monthly financial goals on the summary sheet.

The cool thing about the budget binder is how incredibly easy it is to track your expenses, get aware of your expenses and catch up your bills. But most importantly, personal finance is all about creating systems.

This is one incredibly easy system to help you. It actually gets boring doing this every month, but it is extremely effective.

Start your budget binder today. I would love to hear about your system. Comment below and share with us what tips you have for managing your money. 🙂

Thank you so much for reading.

Best,

It looks like your link to the monthly summary sheet is not working. I know someone that could use something like what you use. Could you fix the link?

Patrick! Thanks for letting me know. The link has been fixed, but here it is- just in case: https://www.dropbox.com/s/45l1ylshuk84kh2/Budget%20Binder%20Cover%20Sheet.pdf?dl=0