In high school, I read a book that changed my life.

David Bach’s “The Automatic Millionaire.”

This book shaped my entire philosophy on saving for retirement and gave me an awareness of how small decisions can make a big difference later in life.

I remember looking at that compounding interest chart and seeing if I saved $2,000 per year from 18-27 and then stopped investing, I would become a millionaire.

For a broke high school student, this was pretty sweet!

This morning, I ran the numbers pretending to be a twenty-something getting started today, with limited funds.

Millennials deal with fairly unique problems. They are trying to balance paying student loans (the highest our nation has ever experienced), having a social life, and knowing there is more to life than work. (No offense Rihanna!)

But somewhere in all this, millennials are missing the mark.

We are not saving enough, not preparing for retirement, and living by the belief of “I’ll make more money someday.”

#YOLO is killing your chance of retiring with dignity

Stop living by the belief that life will be better when you:

• Get a new job

• Graduate college

• Make more money

Coupled with this ridiculously high student loan payments and it’s no wonder you feel like you can’t get ahead.

However, there is something that isn’t being discussed that’s robbing us of our ability to retire.

The money pit

The biggest money sucker, aside from car payments and student debt, is by far eating out. According to Restaurant Marketing Labs, Millennials spend an average of $174 per month on eating out. Just under $6 per day.

Over 12 months of consistently eating out, the average person is eating $2,088 per year. Yikes!

Yet, so many people claim they can’t afford to save for retirement.

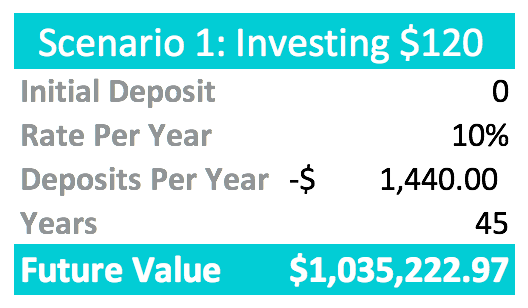

That’s where the $120 a month plan comes in.

$120 Per Month Plan

The $120 per month plan challenges you to do things a bit differently. Imagine if you were to reduce your eating out by $120 a month. So instead of spending $170 a month, you are only spending $50 on eating out. This requires a bit more planning on your end. You will likely have to meal prep and reduce your morning Starbucks runs to special occasions only, but it is totally worth it.

That extra $120 will make you a millionaire when invested.

Let’s get to the math…

If you invest $120 every month for 45 years, earning 10% per month, your future investment would be worth just over $1 million. To be clear- your total investment is $64,800.

Not too shabby for a small sacrifice?

We are talking about $60 per paycheck. I’m very confident when you look at it this way, you will find ways to cut out an extra $120 per month to make you a millionaire.

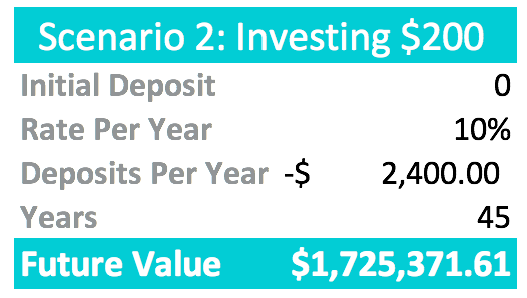

$200 Per Month Plan

Seeing the power of $120 a month is pretty interesting. But what if we got a little crazier and decided to save $200 per month ($100 per paycheck)? What would that do to the future value of the account?

Investing $200 per month over 45 years at 10% rate of return can make you over $1.7 million!! That is a ton of money, for a very small sacrifice. The entire amount of money you are investing is $108,000. Compounding interest is doing the rest of the work.

The Secret

The secret to making a small amount of money turn you into an automatic millionaire is to start early. Compounding interest, the accumulation of interest earned, is one of the greatest “secrets” in the world. The more you understand this principle, the more likely you are to build up a sizable nest egg.

Here’s how it really works:

Pretend you have $1.00 you want to invest today. You know you can invest your dollar into an account that will return 10% interest.

So you put $1 into this account at leave it alone. At the end of year 1, you now have $1.10 ($1 x 10% + your initial investment amount).

You again, leave the money in your account. At the end of year 2, you now have $1.21 ($1.10 x 10% + your initial investment amount).

That measly 21 cents is the secret! I know, a couple dimes and a penny doesn’t seem like anything special, but in this tiny example of $1, your account earned 21 cents for doing nothing. Your interest earns money on your interest.

And the longer you can leave an account alone and let it collect interest, the more money it makes you. Isn’t this the coolest thing ever? The math gets UNREAL as you start investing more money.

The Retirement Tool I LOVE

Personally, I do all my investing through Betterment. I discovered Betterment about 2 years ago and have been in love with it. It’s a robot-advisor designed to help you easily save for retirement. At first I was a bit skeptical, because it can be scary when you are trusting your entire future in the hands of an algorithm. But after further consideration and a shit ton of research, I moved all of my retirement to Betterment.

What I like the most about it, is they use Vanguard funds. Many of Vanguard’s funds require a higher minimum to invest. For example, if you wanted to invest in a mutual fund you might need to kick in $3,000 for the minimum investment. With Betterment, you can invest $100 a month without having to worry about investing a minimum amount.

Here’s the other kicker- just like your interest compounds and makes you a millionaire, the fees associated with investing compound. If you aren’t careful and you aren’t willing to invest on your own (aka passively managed funds), you will pay a hefty premium on those fees. Betterment is a good go-to, happy medium. You can get support that you want, and the fees are .25%. **Just for reference, when I invested in actively managed funds through a large investment company, I was paying 7% and didn’t even realize it.

Try Betterment out today using this special link for 6 months with absolutely no fees!

I hope that this post has inspired you to find ways to cut small things out of your life and choose to invest instead. You may think it won’t make a difference, but the little things add up to millions over the long run.

Forever livin’ debt free,

Whitney

PS. If you haven’t already read David Bach’s book, you can purchase it here. It’s WELL worth the read and had a profound impact on my younger self.

*Affiliate links may be used and commission may have been received in this post and no extra cost to you.

My only question is….where can you save or invest your money that gives a solid 10% return?

Anna, unfortunately, there is no way to predict a guaranteed return. That being said, investing is a long-term strategy and it’s certainly possible to find a long-term average return of 10% through index funds, mutual funds, or exchange-traded funds. The key to remember is this is not without risk. The important piece is to start investing ASAP.