Have you heard that if you work a job in public service for a period of time that you can have your loans wiped?

Me too.

A lot.

I kept hearing people discussing this plan I thought for sure it would be God sent to some people.

Naturally, I was curious to see if it was really all it was hyped up to be.

No surprise, there are a lot of catches and discussion points.

Did you know no one has actually had their loans erased? It’s not even possible until 2017.

Must-Knows (Cliff Notes)

-For Direct Federal Loans only AFTER October 1, 2007 (Sorry, private loans do not count)

-Must have made 120 qualified payments (on-time, monthly payments). Yes, 10 years’ worth of monthly payments made (does not need to be consecutive)

-Payments made before Oct. 1, 2007, do not count towards your 120

-Obama is proposing a forgiveness cap of $57,500 (the federal student loan max)

-At any given time, Congress may cut the program

-Standard student loan repayment plan is 10 years

-Work FULL-TIME (average of 30 hours a week) in public service (firefighting, police officer, teacher, federal, state, local government, almost all non-profits)

-Can count for Parent Plus loans, but this the full-time employment in public service is from mom + dad, not your work history (read the rules on this one)

-If loans were consolidated, you may not be eligible any longer

What this means

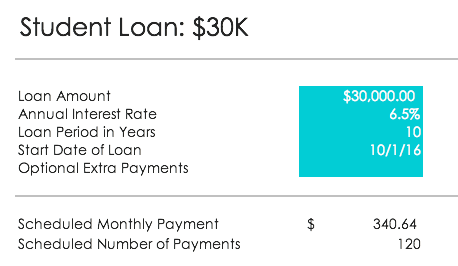

Let’s take the average American situation and put numbers to it. Meet Allie. Allie just graduated from her state university with a bachelor’s degree in elementary education and is carrying $30,000 in student loan debt. All of her student loans are from the federal government. She immediately gets a kick ass job teaching 3rd grade.

Allie’s loan is on the standard 10-year repayment plan, at a 6.5% interest rate, and a monthly payment of $340.64.

This was a bit of a steep payment, so she applied for income-based repayment program—payments based on her income. She’s no longer on the standard 10-year plan. She’s looking at a 20-year repayment plan and her monthly payment is now $223.67 (reduce by $116.97).

Hypothetical #1: Doing the family thing

Allie initially planned on taking advantage of the Public Service Loan Forgiveness program. But life happened. She met the person of her dreams, got married, had a baby, and decided to take a year or two off of work to raise her baby.

Guess what? That one life decision puts Allie even further away from paying off debt. But, she is still eligible for the program. However, her time out of the workplace further prolongs her debt payoff if she is banking on the Public Service Loan Forgiveness program.

Hypothetical #2: Career woman

Allie gets married, has a baby, but continues working full-time teaching. She’s still on the 20-year repayment plan. So she’s eligible for the program!

How much debt will be wiped? $19,648.

Interest Paid

20-year plan, but having debt wiped after 10-years: $16,645 (Allie personally pays)

Interest on the 10-year plan: $10,877 (Allie personally pays)

My Two-Cents

This program sounds good in theory. I personally, would never, ever, for the love of coffee and all things girly, purposely hang onto debt for 10 years in the hopes that a program would save me from being in debt. Especially when this program could disappear at any given time.

Hell. No.

Here’s what I would tell Allie.

Keep your payment at the $340.64 per month. Don’t refinance. And GET A PART TIME JOB! Find a job you can work 20 hours a week, making $10 per hour. Allie will be bringing in $7,200 before taxes and roughly $5,000 after tax.

Work part-time every summer. Make the sacrifice.

For three months a year, work get a part-time job. You will be working 60 hours a week. It will suck, but you will be so glad when you are out of debt.

*Sidenote: This is a moderately aggressive plan. If this doesn’t work for you, don’t sweat it. You can adjust and adapt it to your own life.

What this means does the summer job do for Allie’s life?

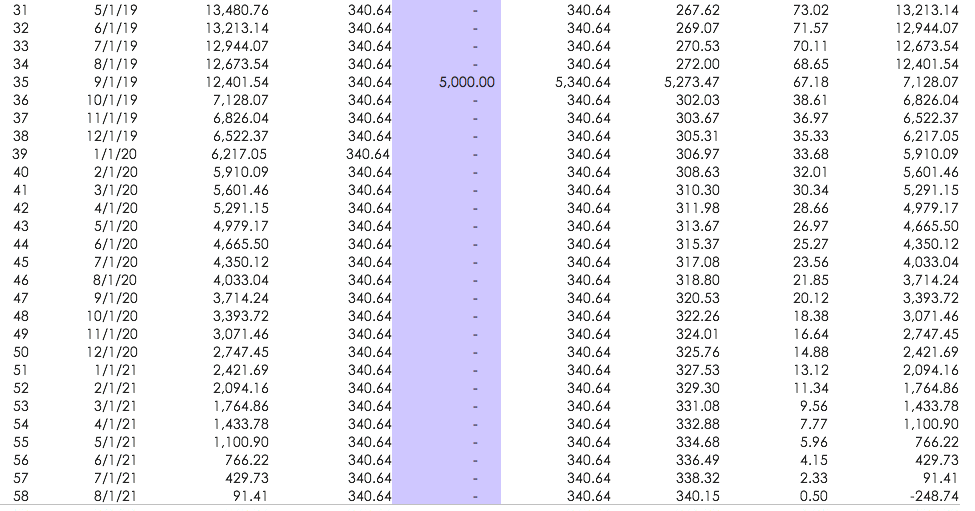

Allie will be 100% debt free in 4.75 years.

By working 3 summers total and making the normal monthly payments, the entire $30,000 will be gone in just under 5 years. To me, giving up 3 summers of your life is a great sacrifice to get rid of the student loans.

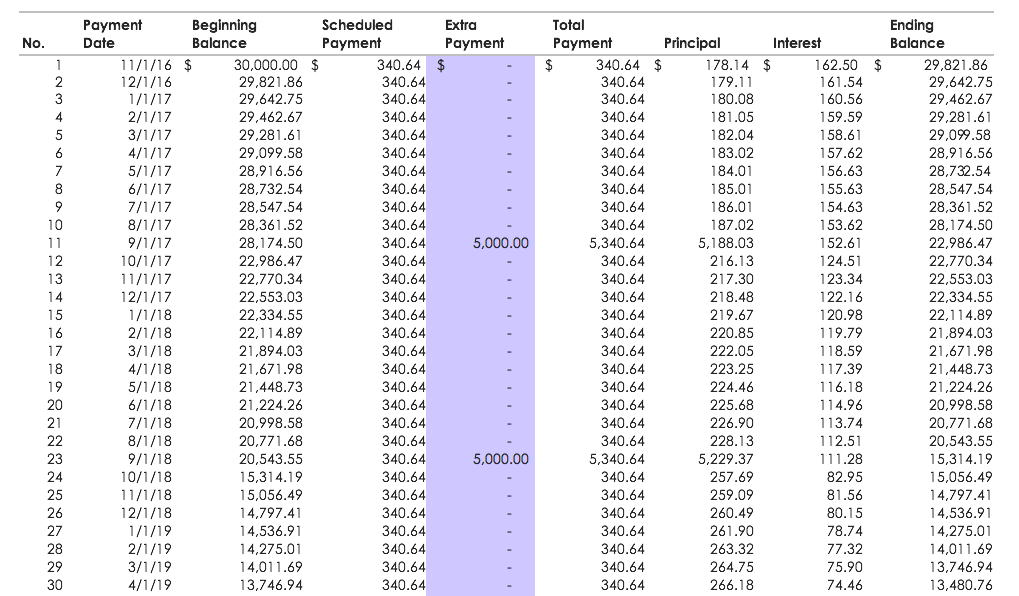

You will also notice that I assumed she saved all the money from her summer job and made one lump sum payment of $5,000 at the beginning of September. The difference between a lump sum payment and monthly payments is nominal in this case. So for simplicity, you’ll see the an entire summer worth of “summer job” income paid at once.

Let’s dive into the amortization table to see how this all works.

After two summers worth of work, Allie will owe $13,480.76 on her student loans. She has one more summer’s worth of work on top of making her $340.64 normal payments.

Let’s take this one step further.

Allie is debt free. She can now start saving towards a vacation, or staying home with her baby. She doesn’t have to be at the mercy of a program that might not even come to fruition.

If she continues the “get out of debt” hustle saving the $340.64 per month she was paying towards debt for the next 5 years, she will have $20,438.40 in the bank. ($340.64 x 60 months)

Public Service Loan Forgiveness: 10 years, no guarantee that your debt will be erased + making monthly payments of ($220-$340 per month) vs. Debt-Free Hustle: 3 summers of working part-time, paying off debt in just under 5 years, and $20,000 in the bank.

It’s the same amount of time, but the results are drastically different.

The missing link…

…is risk. It’s too risky to purposely keep debt around. Shit happens. You may think everything will be smooth sailing for 120 perfect qualifying payments, but it likely won’t.

Risk is a real thing. Just pay off your damn debt. Don’t wait for someone to bail you out. Hard work goes a long way.

Here’s the same candid advice I would give my closest friends and family—

You’re already in a hole. Stop digging and start filling. Don’t put your future in the hands of hypotheticals.

Forever livin’ debt free,

Whitney

*Most of this information was compiled from the U.S. Department of Education. Check out this quick reference sheet for more information.

This information is based on the average student loan amount of $30,000.

I couldn’t agree more. I personally cannot imagine trusting the fed govt to do what it says and I can’t imagine hanging onto debt that long. We have a ton of student loan debt ($590k) and a lot of friends in our same boat are using IBR or PAYE. All these programs are nice in theory but it’s hard to imagine how they will actually play out 10-25 years from now. I’m all for just paying it off yourself, no matter how bad it sucks

Amber, you are spot on! I couldn’t agree more- you never know how life will end up 10-25 years. You might as well buckle up and do the work now. Thanks for your comment. 🙂