If you’ve spent any time on Pinterest searching around for money saving tips or money saving challenges, I’m 99.9% certain you’ve come across the 52 Week Money Saving Challenge.

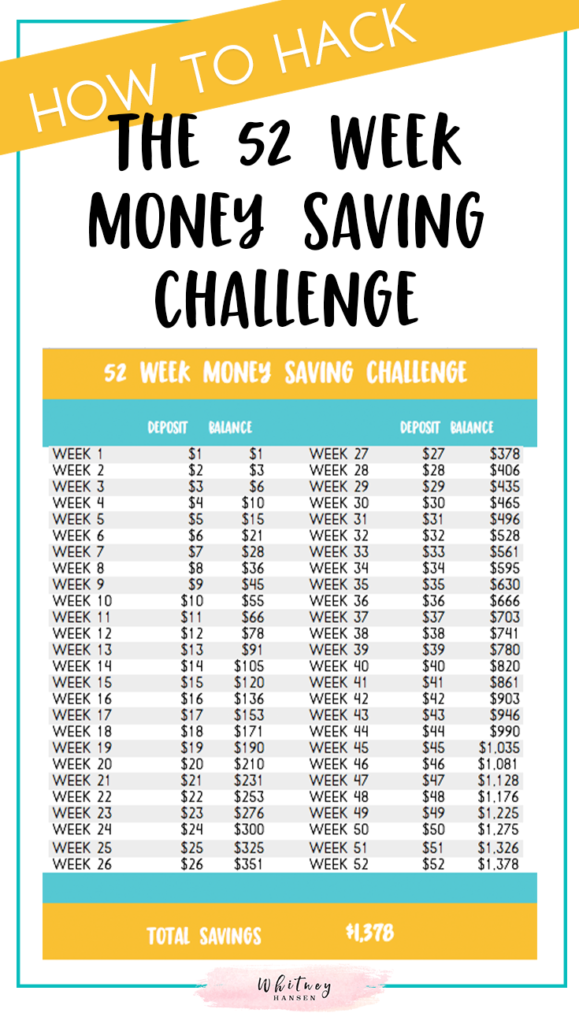

It’s fun, fairly easy to implement and helps you save $1,378 in 1 year.

For most people, $1,378 is a lot of money. If you are just starting your financial life out, that basically becomes your starter Oh Shit Fund. If you are past your Oh Shit Fund, you can use that savings to help you pay down debt. Or this an be used as an extra savings to help you travel the world.

Whatever your goals are, almost $1,400 can go a really long way.

How it works

The whole goal of the 52 week money saving challenge is to keep it so simple that anyone can save money. When you first begin the challenge, you start at week 1.

During week 1 you transfer $1 to your savings account.

Then, as the week’s progress, you’ll transfer the same amount in dollars as the week you are on. For example, during week 5 you’ll transfer $5.

Told ya this is easy!

The cool thing is by the end of the challenge, you will have saved $1,378! That’s a nice chunk of change, right?

A lot of people criticize this savings challenge. Isn’t it better to take equal amounts of money every month and put that automatically in savings?

Yes. And no.

If you are the kind of person who would much rather see the same, consistent amount of money go into your savings account each month and never worry about it again, the 52 weeks money saving challenge may not be the right challenge for you. If this is you- just take $1,378/12 and schedule an automatic savings transfer of $114.83 to your savings account once a month.

But if you are the kind of person who loves to gamify your finances and find a lot of joy in the challenge aspect, then this is a ton of fun and gets really exciting towards the end. Keep in mind that if you started this challenge in January, you’re looking at saving quite a bit of money around the holidays which can cause some potential problems.

How to automate this challenge

If you are trying to manually remember to save that money every single week, you might not actually do it or it might get a bit cumbersome that’s why I like to hack this method through automation.

I haven’t tried to do this with my bank, mostly because it seems like a giant pain in the butt.

And, thankfully, you don’t have to.

There are lots of apps that can help you increase your savings, but my personal favorite for this type of challenge is Qapital.

Qapital is a free app, that allows you to set up rules for your financial life. For example, one of the pre-set rules you can use is the 52 week challenge. All you do is link your current checking account with Qapital and it will pull the correct amount of money for each week that you are on. It’s so easy to do!

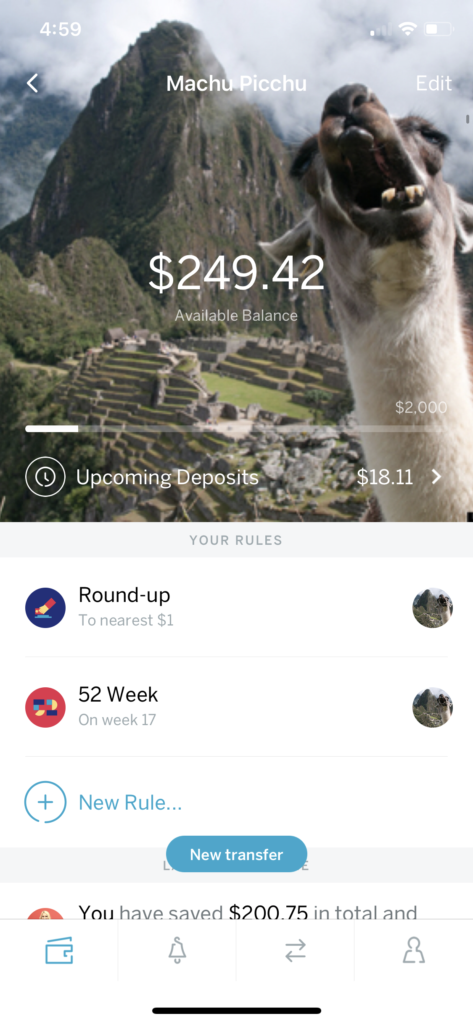

I’m currently saving for a trip to Machu Picchu. The idea of exploring around this world wonder makes me so anxious and unfortunately, it’s not a cheap trip. I anticipate needing $2,000 for the trip.

I set up a savings with Qapital, selected the 52 week challenge AND the round up rule (every purchase gets rounded up to the nearest dollar with the round up being saved) and I just watch the account grow.

I started this in 17 weeks ago and am currently sitting at $249.42. The best part of this is I really don’t miss the money at all. It has not had a negative impact on my life in the least bit and stacking the rules is helping me hit my goal of $2,000 for Machu Picchu even more quickly.

My personal Qapital account

You can select your background picture to be something that inspires you. Apparently, I think a ridiculous llama is inspiring. Haha!

But you can really do some cool money challenges with Qapital like setting a budget for eating out of $50 per week and if you come in under budget, it will automatically save the difference. I suspect I’ll cover that in a future post or video. 🙂

All in All

The 52 Week Money Saving Challenge can be a great way to help you save more money, achieve your financial goals, and start to become a master saver. It takes time to build up a really big savings account, but if you use apps like Qapital or just schedule automatic transfers from your bank account to your savings account, you’ll start to see progress soon!

Take action today and good luck with the money saving challenge!

How to build up a savings (without doing any work)

Enter your name and email to get access to the training instantly.

(link will be sent directly to your email)

Attempted to download QCapital and it says “This item is not available in your country”. Do you know of an app similar to QCapital that is available in Canada.

Cheers

Steph, I’ll ask some of my Canadian friends. I don’t know if there is one that saves. Mylo allows you to invest- which is cool. You might join the FB group Manage Your Money Like A Boss. I am almost certain there is a discussion thread about this in there too.

Link to join: https://www.facebook.com/groups/1631313813822709/