Have you ever wondered if you are paying off debt the right way?

More than likely, you are making one of these ridiculously common mistakes.

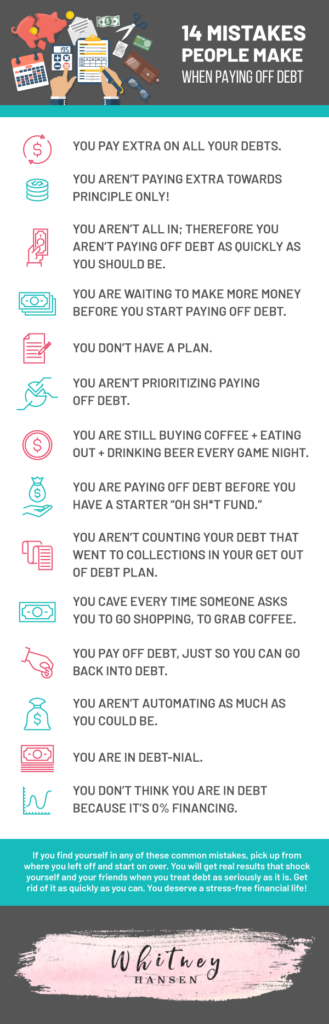

Here are 14 of the biggest mistakes I see people making when it comes to paying off debt.

Knowledge is power my friends. It’s time to educate yourself.

1. You pay extra on all your debts.

Let’s pretend you have $100 extra a month to allocate towards debt and you have 4 debts currently. If you are paying $25 on each of the 4 debts, you are doing it wrong. You aren’t getting as much traction as you could due to a lack of focus.

A) You are going to feel like you will neeeever get out of debt (insert sad whine here), and

B) You are paying too much in interest this way.

Focus on 1 debt at a time. Put that extra $100 towards 1 debt and pay the minimum on all the others.

2. You aren’t paying extra towards PRINCIPLE only!

Dudes, if you aren’t paying your normal required payment and putting the extra amount towards principle only, you are paying extra money on interest that you shouldn’t be. (Principle is the amount you borrowed.) We want as much going towards the amount borrowed and the least amount towards interest.

3. You aren’t all in; therefore you aren’t paying off debt as quickly as you should be.

Your intensity should be like a building is burning down and your puppy is on the 8th floor. RUN, GO SAVE YOUR DOG! That’s the same intensity you should have when paying off debt. Like Fido’s life depends on your hustle. (I sure hope you love dogs!) You need to be so into your plan that you refuse to buy coffee until you pay off debt. That intensity gets you results!

4. You are waiting to make more money before you start paying off debt.

This is simply procrastination. You don’t want to sacrifice your money today to get a kick ass life later. Stop that! Mo’ money doesn’t mean mo’progress, unless you change your mindset. The problem isn’t your income, the problem is your mindset. Mo’ money simply equates to bigger payments + mo’ debt.

5. You don’t have a plan.

It’s like deciding you will learn how to swim a day before you begin a triathlon. You my friend, will sink like a rock! You need a plan. A structured, detailed plan, with actionable steps on how you will achieve your goal.

Your plan should also include writing out a list of your debts, the minimum payments, and what the interest rates are. This can take some digging. Then, if you are smart- which I know you are- you can start optimizing ways to make that more of your money go towards the amount you borrowed instead of interest. This includes negotiating rates with your credit card company, or in some cases refinancing your highest interest rate cards into a personal loan at a much lower interest rate. Read the fine print on this and make sure you do the math to be sure it’s the best choice for your financial situation.

Not sure where to begin with comparing different personal loans? Check out this article on LendEDU.com. They have done all the hard work for us and put comparisons of different companies in one place. Pretty sweet, right?

6. You aren’t prioritizing paying off debt.

Plain and simple. If it’s not a priority to you, you won’t see results.

In my “how to pay off debt” workshop I show you first hand how prioritizing debt can get you results fast.

Check it out here. Seriously, it will open your eyes to how quickly you can see results with small changes!

7. You are still buying coffee + eating out + drinking beer every game night.

(And not putting the money away towards debt.) Small things add up and really matter. Even an extra $100 a month can put a big dent in your debt.

8. You are paying off debt before you have a starter “oh sh*t fund.”

Be sure you get money set aside for minor emergencies. Do not start paying off debt before you have a baby “oh sh*t fund” of $1,000. Why $1,000? That is typically enough to cover most insurance deductibles and prevent a small inconvenience from becoming a catastrophe.

My personal favorite place to put my “oh sh*t fund” is with Ally Bank. They have a basic savings account that pays 1% per year. Sure it’s not enough to retire off of, but it’s certainly better than the .025% most other banks pay.

9. You aren’t counting your debt that went to collections in your get out of debt plan.

Imagine being out of debt and ready to buy a home only to get your application denied on the spot because you have $20,000 in debt that was sent to collections- and you didn’t even know about it! That stuff happens. Be sure to run your credit report (annualcreditreport.com) to not have this stuff sneak up on you later in life.

10. You cave every time someone asks you to go shopping, to grab coffee.

This is especially hard if you are a social being. I totally get it, but at some point you have to say no so you can get progress faster. If for some reason you truly can’t give up dinner dates- find ways to be creative. You can often find amazing deals by hitting happy hour instead.

One of my favorite tips for still enjoying eating out with friends is to use Groupon. You can find some really amazing deals for restaurants in your area. I recently scored wine tasting for my BFF and I for just $10. Split two ways I’m looking at $5 for an awesome experience. And they even have a deal running to get $20 worth of sushi and/or martinis for just $12 at a swanky sushi place downtown ($6 if you split with your friend).

Of course, if you can avoid spending extra cash when you are paying off debt you’ll be better off, but I understand that is easier said than done sometimes.

11. You pay off debt, just so you can go back into debt.

If I had a nickel for every time I heard someone say “I”m trying to pay off my credit card so I can finance a car,” I’d be giving Warren Buffet a run for his money. This mentality is detrimental. You have officially accepted debt as part of your life. That may be okay for you, but that sure is hell is not the way I would want to live my life. Talk about stressful!

So please, for the love of puppies and sunsets, STOP paying off debt just to immediately go back into the debt cycle.

12. You aren’t automating as much as you could be.

Make your monthly bills automated so you aren’t accidentally missing a payment. Then when you have extra money, you can select which debt you are focusing on and put the extra towards that.

A dear relative in my life goes through this all-the-freaking-time. Forgetting to pay bills, racking up late fees and then being faced with massive $150-$200 bills the following month. If you are one of those people- automate your bill pay. It makes life easier and prevents you from getting a whopping past-due bill.

13. You are in debt-nial.

It’s not that you don’t want to eventually pay off debt, it’s that you have no idea how much you have. You my friend, are experiencing debt-denial… debt-nial.

Get very clear on what you have. Debt is money that you are personally responsible for. If you are thinking I’ll pay this off when life calms down and I magically get a 10% pay raise, you’re doing it wrong. Start prioritizing it today. Rip the bandaids off. It hurts. I know. But you need to have the strength to face reality with your financial life.

14. You don’t think you are in debt because it’s 0% financing.

This absolutely is debt. Try making a late payment and see what happens. That company that gave you such a good deal will turn into an ankle biting poodle, back-charging you for interest at a “nice” 22%.

Zero percent, is NEVER just zero percent. It’s still debt.

Treat it that way.

If you find yourself in any of these common mistakes, pick up from where you left off and start on over. You will get real results that shock yourself and your friends when you treat debt as seriously as it is. Get rid of it as quickly as you can. You deserve a stress-free financial life!

Forever livin’ debt free,

Whitney

Need extra help with paying off debt? Check out the FREE workshop for paying off debt.

It’s all discipline. I like the emergency fund comment. I think people often forget about what I believe to be one of the most important rules in personal finance: Pay yourself first. That will instill in you discipline in more facets of your financial life. That money isn’t for spending on beers on game night; it’s for building your future and you can’t touch it. Such an easy concept that people often overlook.

Good write up!

-DP

Thanks for your comment. I couldn’t agree more! You’ve got to PYF + be disciplined. 🙂

Great article, I agree completely that it seems like a low priority to a lot of people. They want to but they only do a half assed attempt.

I say suck it up and do it as intensely as you can even if you just schedule that intensity for 3 month out of a 2 yr repayment plan it will do so much good

Yes!! Sounds like we’ve got the same philosophy. Go all in and get it done as soon as possible. (Rip the bandaid off quickly.)

Number 2 doesn’t make sense. If you’re paying off the principle, that means less interest will be created.

Hi Paul, You are correct, but what I’m discussing is a bit different. If you’re payment is $200 per month and you decide to pay an extra $100, you need to make sure you specify that the $100 extra payment is going towards principle only, instead of making a $300 payment and not specifying. Without specifying, most times you are paying interest on the entire $300 instead of just $200.

Hope that provides some clarification. 🙂

I love this list–it’s awesome! I particularly like the last item. To me, any debt, even low or no-interest debt is BAD because it’s a liability!

Claudia, right? I’m so glad I’m not alone on that. Thanks for your comment. 🙂

I used to be really guilty of #1. I would try to work on ALL of my personal finance goals at once until I realized that was getting me nowhere. Now I focus on one at a time and it’s having an impact! Plus it keeps me motivated! Great list.

Oh for sure! I used to do the exact same thing, until I realized how much more progress you see focusing on one thing. (I have a huge case of shiny object syndrome, so that is usually a struggle for me.)

Hi Whitney,

This is my favorite article of the day – we are on the EXACT same page. We teach the Debt Snowball to our clients and I am going to be sending out follow emails to all clients w/ a link to this. My favorite : “debt-nial” 🙂 nice work !

Chris,

That is awesome! The debt snowball is my favorite too. 🙂 I appreciate you sharing this post. Sure hope it helps inspire someone to pay off debt.

Hi Whitney!

Could you please clarify #2 for me? How do you specify the addl. payment is going towards the principal? Thank you for the inspiring article!

Devin

Hi Devin! Thanks for your comment. When you go to pay extra money in a lot of cases it will have an option that allows you to put extra towards principal. If you don’t see that, call the company and see how they have their extra payments structured. Sometimes they don’t allow that.

Hi Whitney! Great article. I totally agree with you especially on #7 people doesn’t usually pay attention to that. You’re definitely right small things add up and really matters 🙂

http://www.cybergenic.net/

Thank you so much!

you forgot to mention-your spouse is not on the same wavelength as you and spends money like it comes from a faucet no matter how much you beg him to stop.

YES! This should definitely be included on the list!!