I recently did a massive survey of WhitneyHansen.com subscribers. Here’s what I found- many people are unsure of what they should be doing at each stage in their financial life.

I recently did a massive survey of WhitneyHansen.com subscribers. Here’s what I found- many people are unsure of what they should be doing at each stage in their financial life.

You might also be confused on if all the feelings you are experiencing are borderline crazy or totally normal.

So let’s talk about this.

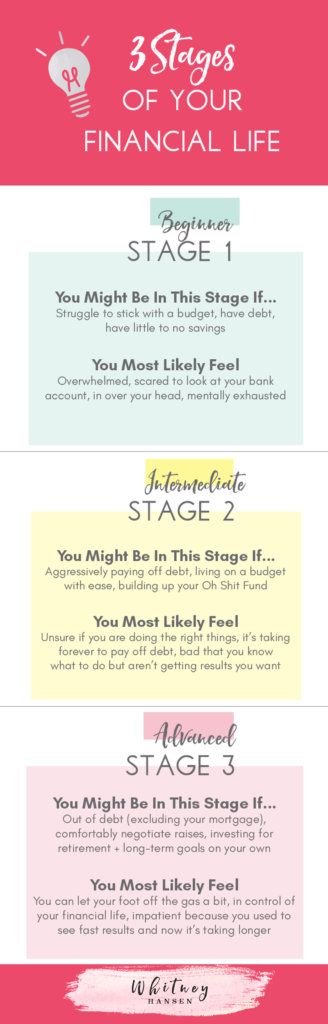

There are typically 3 stages in your financial life.

Beginner, intermediate + advanced.

No shame with any of these either. We all start as a beginner and hopefully, graduate to advanced, and eventually financial independence.

Stage 1: Beginner

You might be a beginner if you…

- Struggle to stick to a budget

- Have a little to no savings + if an emergency hit- you’d be SOL

- Carry debt + aren’t quite sure what the best pay down strategy is

- Have debt + aren’t concerned about it because you can afford the monthly payment

- Get scared when you hear people talk about financial lingo (IRA, life insurance, zero sum budget, liquid assets, cashflow, stocks, bonds, index funds, asset classes, liabilities, hedging your risk, etc)

Normal feelings + emotions you might be experiencing during this stage

- Overwhelmed + in over your head

- Stressed out- just thinking about money stirs up all the feels

- Scared to look at your bank account

- Lost + confused- why should I even bother?

- Silently praying that your card isn’t declined when you swipe your card

- Feeling like you are constantly broke

- “I should be further than I am in my financial life”

- “I know I should be better with my money, but I’m just not sure where to start”

Metrics to hit before moving to the next stage

- Save 1 month of living expenses in your starter Oh Shit Fund

- $500 buffer in your checking account so you don’t overdraft

- Clarity around exactly how to pay off debt

- Organization around your finances

- Grasp on financial vocab

- Detailed budget

- Knowing how to navigate + where to pull your credit report

- Automation of your monthly expenses + savings

- Setting up your savings on autopilot

How long does this stage last?

1-3 months

Stage 2: Intermediate

You might be intermediate if you…

- Live on a budget comfortably every month

- Actively + aggressively paying off debt

- Building up your Oh Shit Fund

- Putting some money into retirement, but not sure what it all means

- Know exactly how debt interest is charged (simple vs. compound interest)

- Understand that not all debt is created equal

Normal feelings + emotions you might be experiencing during this stage

- Unsure if you are doing the right things at the right time

- “I should know how to do this, so why am I struggling”

- “I work hard. I should be able to treat myself without feeling guilty”

- “I just need to earn more money”

- It feels like paying off debt is taking forever

- “Should I be saving for retirement while I’m paying off debt”

- You are constantly saying no to family + friends invites

Metrics to hit before moving to the next stage

- Building up 6 months of living expenses in your Oh Shit Fund

- Aggressively paying off debt by reducing lifestyle + increasing income

- Living on a budget with no problems

- Investing in your future by putting 20% into your IRA

- Being able to explain how credit card interest is charged + how that differs from amortized loans

How long does this stage last?

6 months- 5 years

Stage 3: Advanced

You might be advanced if you…

- Are out of debt (excluding your mortgage)

- Investing for retirement and long-term goals on your own

- Plan on paying off your mortgage at a maximum of 15 years

- Build your credit without carrying balances on your cards

- Saving for your kids college funds using a 529 or UTMA

- Comfortably negotiate raises

- Investing in real estate or a second home (without feeling the extra monetary stretch)

- Minimizing the amount of taxes you pay every year

Normal feelings + emotions you might be experiencing during this stage

- “I don’t stress about money as often as I used to”

- Impatient; everything seems to be taking soooo long to get results

- “When do I need to hire a CPA?”

- You fear market dips (especially if you’re over leveraged or not diversified)

- Unsure if you should put extra towards long-term investments or retirement

Metrics to hit before moving to the next stage

- Completely consumer debt free

- Diversification in your overall portfolio

- Tracking your net worth and seeing a growing trend line month after month

- Investing on your own outside of retirement

- Maxing out your retirement contributions every year

- Pay your mortgage off within 15 years

How long does this stage last?

Largely dependent on your goals, but typically between 5-15 years.

What’s after stage 3?

Financial independence.

That’s the entire goal of life is to get to the point where money is no longer a barrier to your life. You can choose between continuing to work for fun, or hang up your hat and hang on the beach for a while.

Pin this infographic to remind yourself of the different stages, and common feelings through each stage.

These stages were compiled from working with hundreds of people in various life stages. I started realizing that blanket advice wasn’t working because everything was at different levels in their lives.

I hope this helps you identify where you are and what you can do to “level up.”

If you need help getting to the next level, I would love to work with you individually through one-on-one coaching. Coaching can help you level up as quickly as possible so you can get to financial independence.

Learn more about coaching here.

How to Pay off Debt Workshop

Enter your name and email to get access to the training instantly.

(link will be sent directly to your email)

I really appreciate this post! I struggle with a perfectionist mindset and am constantly beating myself up for not being where I think I should be in every aspect of life including financially. This post helped show me that I have taken significant steps forward and am somewhere between Beginner and Intermediate, it gives me a lot of hope to see milestones broken down so simply-I can focus on one thing at a time instead of thinking I should already be Advanced when I’ve only begun my journey toward financial independence less than a year ago. As always thank you Whitney for the awesome and thoughtful content ????

Ugh! Yes, the perfectionist mindset can cause lots of frustration. Congrats on your progress so far! Sounds like you are taking the right steps to becoming financially independent. 🙂

Proud of you! Super glad this post resonated with you.

Thank you so much for this article. This is exactly what I needed. I do get overwhelmed and stress out about my finances sometimes but this has reassured me that things will work out in time, you just have to keep moving forward. Take Care Whitney!

Thanks Sherell! I’m glad this was helpful. I understand how overwhelming it can feel, but I’m glad you are taking the right steps to reduce your stress later. 🙂

Whitney, thank you for this post! I often wonder if I’m where I’m “supposed” to be, and how that might compare with others around my age. Especially now, as I am dabbling with venturing into entrepreneurship, it’s even more important for me to calibrate what stage I am at – and also to inderstand the finances of my future clients as well! Thanks so much for such a thoughtful, and well laid out post.

Thanks! And you are 100% correct. Nothing brings out financial mishaps quite like entrepreneurship. I’m glad you are working towards your financial life today to make your entrepreneurial journey better later.

I enjoy this article. I was able to identify what level I was at – beginner. And I got a clearer picture of the direction I want to head in and some things I can do to get there a little faster with more peace of mind.

Nice! I am so glad it was helpful for you. 🙂

I love this post! it is so informative and allows me to see that there is a next level to my financial journey. Great post, Whitney! I feel amped to get to the next stage!

Woot woot! Glad you are ready to get to the next stage! You’ve got this!

Thank you so much for presenting this information in a blog format and broadcasting it on your Podcast. I listened to the podcast while running yesterday morning and came back just now to use your blog as I do some family finance/investment research and planning.

I enjoy learning from you. Keep it up! I know you’ll surpass 200 episodes as you continue to learn and share your knowledge!

Thanks so much Laura! I truly appreciate your support and am glad you enjoyed it! 🙂

Hi Whitney,

I wanted to clarify what you mean by 20% into your IRA, is that 20% of the yearly limit ($1,100 of $5,500)?

Thanks,

Em

Ooh! Good question. Ideally it’s 20% of your income. So if you make $40,000 you are saving $8,000 towards retirement. For the split, if your company has a 401K I’d contribute enough to get the match, and then put the rest in a Roth and/or Traditional IRA.