Say whaaaaat?

You’re probably thinking what the heck- that’s not possible. And I’m about to educate you on how I did this.

Just to give you some background on my financial life so you understand the whole picture.

- I used to finance furniture, up until I was 20 (*damn you RC Willey for having cute stuff*)

- I opened an account at a tire store and financed new tires when I was 18. (never did that again)

- I once upon a time used a credit card with a $250 max spending limit. (used it for 3 months before cutting it up because I saw how easy it would be to get into debt)

- I had student loans (paid off all $30,000 worth when I was 23)

- I financed a $7,500 car when from age 18 (paid it off in 1.5 years and still drive the same car today)

- I bought my home when I was 19 (still live in it today)

- To this day, I do not use a credit card (primarily because I don’t care about rewards, or spend enough for to make it worth the hassle)

- I am now 28

All this to say, I have a history of using credit in my “dumber” days.

I didn’t understand how credit worked, I just new in accounting school I was taught the power of OPM (other people’s money) and said ,”YEP, sign a sister up!”

Thankfully, I learned my lesson that playing with debt and credit is stressful. But I think knowing that I did these things is important because it will help you understand why these things impacted my credit score in a positive way.

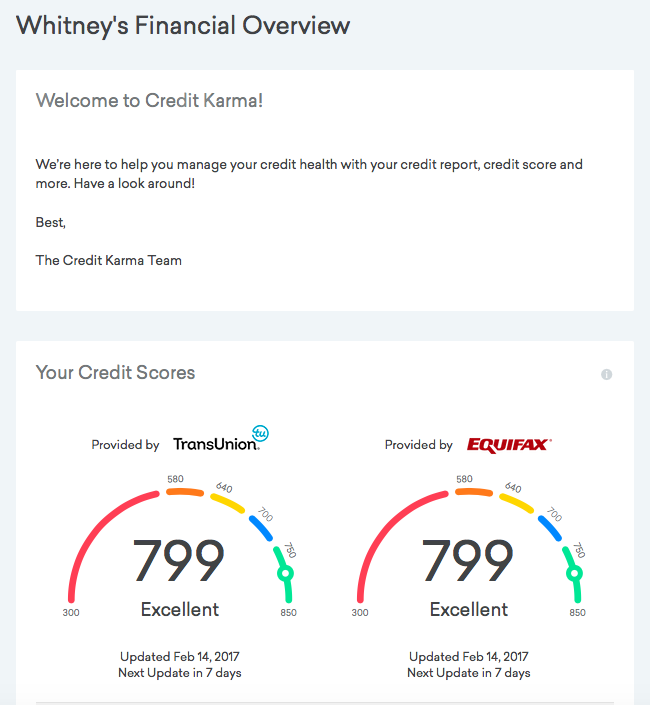

How I have a 799 credit score and haven’t used a credit card since 2007

Let’s dive into the logistics behind how your credit score works.

It’s composed of a few different things, but the ones we will be focusing on is:

- Length of history

- Capacity + utilization

I’ve got two things working in my favor.

Length of history

The longer you have had an account open, the better that is for your credit score.

This means that the before you decide to close accounts you no longer use, think about this carefully. Strategically pick which account would be best to close based on how long the account has been open.

Remember, my silly $250 limit credit card and tire line of credit?

Those are still open in my name. Now, I don’t use them and probably never will, however they are working in my favor by showing that I have a history of credit.

If you are wondering how the heck you find out how long an account has been open, there is a free way to do this.

Pull your credit report at annualcreditreport.com

Your credit report should be pulled once a year anyways- as a housekeeping kind of thing- but it will show you exactly when you opened an account, how much the credit limit is, and even if you made any late payments. (which I know you won’t, right?)

So long story short, you may not want to close the accounts that have been around forever. They are helping your credit score.

Capacity + Utilization

Capacity is the amount of credit you have available to you.

Let’s break this down into smaller chunks. If you have two credit cards:

- Credit Card 1: $10,000 limit

- Department Store Card: $1,500 limit

If you have nothing charged on these cards, your utilization is 0%. If you charged $3,000 on CC 1 and $500 on Department Store Card. You have $3,500 charged total. If you take $3,500/$11,500 (total credit available) you’ll get 30.4% utilization. Basically you are are using 30.4% of the credit available to you.

Before you say that’s a good thing or bad thing. You need to know a few “rules of thumb” with your credit score.

Rules of Thumb

- Using more than 50% of your overall available credit is considered harmful to your credit score

- Ideal utilization (use) is between 0-20% per credit card

- Carrying a balance DOES NOT help your credit (more on this below)

Utilization

In the example above, the overall utilization was 30.4%.

- Credit Card 1’s utilization is 30% ($3,000/$10,000). <— more than the recommended 20% max utilization.

- Department Store Card’s utilization is 33.3% ($500/$1,500) <—also more than the recommended 20% max utilization

Using more than 20% of your credit limits is a signal to the reporting agencies that you are higher risk for defaulting or using credit in a poor way.

If you are being responsible and you don’t want this to harm you, there is one thing you can do to reduce your utilization…. ask for a credit limit increase.

Don’t use your more of your limit just because you have it- that would be silly- but what that will do is lower your utilzation, so you might not be getting penalized as heavily.

How this benefits me

You might recall that I don’t use my available credit.

Because of this my utilization is 0%. This is showing that I am being responsible with my credit and not putting my financial life in risk by overusing credit.

It’s fascinating that just having the availability of credit without actually using it can be hugely beneficial to your credit score.

Smart + Savvy Way To Build Credit

If you are trying to build your credit there is an easier way to do this.

Somewhere, we got the shittiest education I’ve ever seen and passed down the most God-awful advice to people about building your credit.

So let me just clear this up now.

Carrying a balance on your credit cards IS NOT the way to build your credit. It’s not a requirement. It’s not necessary and if you do this you should stop probably cut up your cards and start living on a budget before reintroducing credit cards.

I repeat…

[Tweet “It is a myth that you must carry debt to increase your credit score.”]

If you are one of those people telling others they need to keep debt around to build their credit, STOP IT! It’s wrong and it’s causing a lot of problems for people’s financial lives.

Here is the advice I give my students in my personal finance class:

- Open up a credit card with no annual fees

- Charge one recurring payment on there. (Netflix, Hulu, gym membership, cell phone) Just one

- Schedule an automatic payment from your checking to pay off your Netflix, Hulu, gym membership…. etc. whichever account you charge

- CUT THE CARD UP or put it in a mason jar full of water and put it in your freezer

Congratulations, you are building credit! Seriously. It’s that easy.

This post has barely touched the surface of credit. I know this a hot topic for people and I understand why- which is exactly why I brought in my friend Eric Leigh to create a FREE course on Credit.

It’s pretty awesome and again- it’s free. So definitely check it out.

Join the course here: http://whitneyhansen.teachable.com/p/credit-101

My score is 830 and I have zero in debts. We use the card for auto pays and for convenience but haven’t run a balance ever, not even once. I realize many people can’t do that safely but it never was hard for us. Anyway your plan sounds as effective and safer than ours, great post!

Steve, it sounds like you found a pretty good system that works for you! Keep up the great work! 🙂

Hello Whitney,

You are awesome and thank you for the amazing advice!!

~Alex

Thanks for stopping by! I appreciate your support. 🙂

Hello there!

I’m just curious how it is possible for you to still have an open credit account without using it since 2007? Any credit company I have ever had will close unused accounts within one year.